Startup Development Organizations Critical to our Future

A critical stage of innovation, startups uncover new business models that fuel global innovation and economic progress. Entrepreneurs generate solutions, new products, innovative services, and disruptions that change the world. Startups are the embodiment of innovative and aspirational entrepreneurs with incredible ideas begging an apropos question in cities, governments, and economic development organizations: how might we fuel that ecosystem here?

According to startuprankings.com, the United States fosters around 70,000 startups at the moment, followed by India with nearly 13,000 startups, and the UK with around 6,000 startups.

[of course, we should be accounting for statistical errors in the data as we all know too well that Pitchbook, Crunchbase, AngelList, dealroom.co, and other aggregators of startup data do a wonderful job but can’t possibly know them all – Google can’t even keep up with the vast amount of data to aggregate]

The point is, specific numbers aside, there is a great gap in the number of startups in the United States compared to other countries. More intriguing is that the counts are inconsistent when contrasted with population or economy. The US has three times more startups than anywhere else. Whether by geographic size, population, or economy, we can’t possibly account for such disparities when it’s simple enough to see that a much more vast population such as India has a relatively small fraction of startups, while a far smaller population (the UK) is party to a greater relative share.

What creates entrepreneurial people is society and culture.

Successful startup founders are driven, tenacious, and passionate, and since startups aren’t “tech,” and they’re distinct from new businesses in that they’re innovative and often disruptive, we can start to look to our region of the world and ask what’s being done to help foster entrepreneurial people. We can’t teach someone to be an entrepreneur; we can teach them how to start and run a business. We can’t guide someone to the “correct” way to create a company; we can only mentor and advise from experience what will likely work, and what will assuredly not. It’s impossible to manifest an invention and just be innovative; the very nature of this work relies on experiments, research, risks, and trials.

Startups are a series of lessons from failures, pivoted into new opportunities while avoiding mistakes.

While we can’t teach that tendency, that culture, we can develop a culture and society that inspires people to be entrepreneurial and enables entrepreneurs to take the risks involved in being founders.

If we do not change the way we teach, in 30 years we’ll be in trouble. We teach our kids things from the past 200 years, it’s knowledge-based, and we cannot teach our kids to compete with machines who’ll be smarter.

We have to teach our kids something unique, so that a machine can never catch up with us: values, believing, independent thinking, teamwork, care for others – the soft skills – sports, music, painting, arts, to make sure humans are different from machines.”

– Jack Ma; World Economic Forum, Davos, Switzerland in 2018

Startup Development Organizations inspire entrepreneurship and enable entrepreneurs to take the risks involved in being founders

- A hub, such as 2112 in Fort Knox Studios in Chicago, connects large parts of a startup ecosystem and makes it easier for everyone to connect and get involved – all under one roof: office space, shared common areas, entrepreneurs, advisors, capital, and mentors. I find myself in Houston as we speak, at ion, easily one of the most innovative uses of space in the country; the region’s hub from which spokes reach to other programs and places.

- Entrepreneurs and intrapreneurs benefit from Innovation Labs, such as (outside the box I suspect since you might be focused on R&D, wet labs in biotech, or corporate innovation programs), AFWERX, the innovation arm of the United States Air Force. Innovation labs, and organizations by other names, help develop and commercialize Intellectual Property (IP and patented works) through collaboration with companies and incubators aligned with industry objectives.

- Incubators which teach entrepreneurs and work with product or business ideas to develop solutions and start companies more likely to succeed, thanks to resources, networks, curriculum, and programming. Greentown Labs a Houston incubator focusing on climate technology is a wonderful example in a sector beyond our own programs for MediaTech

- Accelerators increase sustainability and impact, drive growth, and evolve startups into competitive, scalable companies. Assuredly, the best known among accelerators is Techstars; typically, Accelerators are defined by extensive communities of partners and investors, media relations as startups are ready for the world stage, and their own financial investment (ranging from $10,000 to $100,000).

- Venture studios, or as I prefer to call them, Startup Studios, establish replicable models for the early phases of startup development, reducing the risks for founders and investors, by participating themselves as one of the partners in the new ventures – Startup Studios serve as a technical co-founder, at least and if not more so, with ownership in exchange for the work.

Startup Development Organizations are critical to the future of our economy precisely because the way we work requires that we’re more innovative, more creative, and more comfortable with risks. It’s here where people can vet ideas, test possibilities, hone their pitch, determine product-market fit, expand their network, and create solutions that might become companies.

Leaving us though with a question as of yet unanswered. While we can simply put such things in our cities, such a thing alone does not an ecosystem nor healthy economy make. We know full well from our experiences thus far, our cities don’t become “tech hubs” or startup epicenters (or, god forbid, “the next Silicon Valley”) thanks to Venture Capital, attracting tech companies, nor the government funding an innovation space – at least not such things alone.

How might we fuel that ecosystem here?

Developing Startup Ecosystems

Venture Development

“Startup ecosystems include the startups themselves and their founders, employees and contractors, the angel investors and venture capitalists who fund them, and the incubators, co-working spaces and accelerators that house them, along with business plan competitions, universities, educational classes, bloggers, community groups, tech meetups and other support organizations that help them,’ David Rose, CEO of Gust. “It additionally includes the professional service providers they engage (law firms, accountants, investment bankers, et al) and the larger corporations who serve as their customers, partners and eventual acquirers.”

Think that can be done through your city’s public policy? Perhaps an ecosystem so vast is as simple as a model for the Chamber of Commerce to execute? Maybe. This is like economic development, but it’s not.

Economic development is the governmental objective of improving civilian standards of living with the creation of jobs through improvements in infrastructure and education

Economic development is usually the focus of federal, state, and local governments to improve our standard of living through the creation of jobs, the support of innovation and new ideas, the creation of higher wealth, and the creation of an overall better quality of life. Economic development is often defined by others based on what it is trying to accomplish. Many times these objectives include building or improving infrastructure such as roads, bridges, etc.; improving our education system through new schools; enhancing our public safety through fire and police service; or incentivizing new businesses to open a location in a community.

– Drawn right from the curriculum of Economics study

How much of that sounds meaningfully and directly beneficial to startups? Oh indeed, it serves an economy in which startups flourish, after all, “in support of innovation and news ideas,” “the creation of higher wealth,” and “overall better quality of life” are shared values with most entrepreneurs, but the creation of jobs, schools, and even public safety aren’t the initiatives that REDUCE risk and inspire ideas so that a community might fuel more startups. Notably, our definition distinguishes too, “incentivizing new businesses to open” – startups aren’t new businesses!

Venture Development focuses on the distinct risks and resources of Angel Investors and Venture Capital, the programs and Startup Development Organizations that capably and effectively foster founders, and the strengths of the regional economy and sectors of industry, to develop the venture economy.

While not formally nor consistently defined, it’s time we start doing so, so let’s draw from Economic Development to distinguish Venture Development, “Usually the focus of the private sector, in support of the public sector, to improve the outcomes of the efforts of entrepreneurs and early stage investors, through the direction, promotion, and development of the startup stage of an economy, driving innovation and new ideas, creating opportunities, and enabling a distinct, diverse, and accessible culture and ecosystem in which startups thrive. Venture development could be simply defined as increasing the rate of startup development and investor return. Many times these objectives include building or attracting Startup Development Organizations; improving economic policy in support of innovation spaces and coworking; ensuring sector-specific education to foster a workforce ready to work on behalf of startups in the region; enhancing community and communications to remove barriers to entry and create greater awareness; and incentivizing established companies to open a location in the region as those companies bring resources to bear on behalf of the entrepreneurs.”

Developing a Flourishing Startup Ecosystem

Startups exist not thanks to venture capital nor tech, and not thanks to a single innovation hub or entrepreneur program at the university, but thanks to the interaction of incubators, coworking spaces, startup studios, accelerators, venture capital, and innovative companies, serving one another as an ecosystem wherein the founders can afford the risks taken.

Yes, I said flourishing startup ecosystems depend on companies.

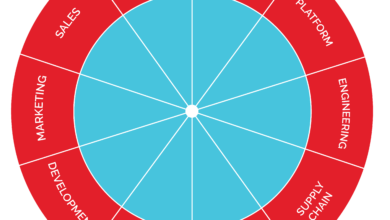

Let’s organize Startup Development Organizations into more distinctly define categories, and then add in the fact that Venture Development takes a more holistic look at your ecosystem, and visualize how Venture Development is the work of helping these entities work harmoniously and synergistically (yes, I did just use that buzzword).

Companies

Companies provide sector stability in that they offer the jobs, job training, and even some capital investment (sponsorship) of the industry itself. A region with only one company in a sector isn’t likely well developed but when considering how Los Angeles is home to many entertainment companies, or that Houston is the city most energy companies call headquarters, you might appreciate that such companies make it easier for everyone else in that sector to take risks. Company executives and directors are ideal mentors and angel investors while the companies themselves are the initial partners founders seek in what they’re working to manifest.

Incubators

Incubators teach founders while providing the resources and a network of peers and mentors, familiar with this stage or those sectors in particular.

Notice now in our visual, how Companies overlap with Incubators; and likewise, how each element of a startup ecosystem overlaps with another, all supporting the venture development work.

Companies sponsor incubators, provide many of those mentors, and often even operate incubators of their own, such as Comcast NBCUniversal’s LIFT Labs. Overlap in venture development.

Coworking

Regardless of the implications of COVID-19, the Great Resignation, remote work, or working from home, the bottom line is the same, that with property unaffordability (evident in housing), we’re realizing the untenable cost of office space. And more importantly, the fact that the last thing a startup should be spending money on is a room in which to work. But a shared space? Coworking lowers the cost of workspace while also serving as event space and providing what’s considered “coincidental collisions” – running into like minded people (and potential team members).

Our overlap draws from Incubators in that Coworking spaces serve as places for our incubators to operate; in as much as a founder shouldn’t pay for office space, from a Venture Development perspective, it’s silly to make our Incubators pay for property just to exist – we want them thriving on behalf of the founders.

Still not sure how? Cheryl Winokur Munk reports in the Wall Street Journal: Study finds working in close range led to knowledge-sharing and faster innovation.

Startup Studios

We’d do well bundle our Innovation Labs and other forms of R&D among our Startup Development Organizations in with Startup Studios because similarities exist (though operations and models might differ). It’s here where Intellectual Property is more meaningfully researched, developed, and commercialized. Distinct from Incubators, which teach founders and help develop the ventures, think of these more in the context of the product development and the value of that asset as an opportunity. Startup Studios tend to align with specific industries as resources applicable to what’s being done, are paramount in success herein – wet labs, robotics spaces, film studios, and creative design hubs, would all be considered similar.

Like the use of shared workspace, coworking, by incubators, our overlap between Startup Studios and Coworking is in the shared use of such spaces and the collaborative way in which a lab or venture studio could also be or be part of coworking.

Accelerators

Providing seed capital to accepted startups, Accelerators play a later stage role than Incubators and we’d do well for our economy by correcting people who use “Incubators and Accelerators” as a phrase as though these two are interchangeable. Accelerators accelerate. I’d be hard-pressed to put it more bluntly; it’s inappropriate to characterize Accelerators as for ideas just as it would be unwise for founders starting out to focus on Acceleration. Expect Accelerators to do the work that accelerates your venture, providing things like Media Relations and other means of scalable growth, access to relevant partners since you’re ready for them, and more direct access to capital than mere introductions and office hours.

Drawing from Startup Studios, our overlap manifests in that we have ventures at a stage well beyond Incubators. Founders should know what they’re doing (perhaps from an Incubator earlier), have developed solutions (IP and products – such as what emerge from Startup Studios), and we’re ready to *go*

Venture Capital

Notably NOT in my previous Startup Development Organization brief, in as much as neither are Companies, Venture Capital is a critical facet of Venture Development because it serves as both the aggregator of capital resources (referred to as Capital Formation) and exists as a signal of a healthy startup ecosystem. Too often neglected, is that Venture Capital (and Angel Investment) gets involved with startups seeking a Return on Investment; that manifests as a result of an “Exit” – either a venture going public and becoming a publicly traded company, or getting acquired.

Thus, Venture Capital, helps drive founders to exit; cycling capital back into funds, through successful founders, and moving Intellectual Property and innovative team back into Companies.

The Venture Capital facet of Austin, TX is flourishing today, as an example of aggregation and signal, because it's today, a result of recent years of development, that Austin meaningfully has each of these facets in place.

We overlap Venture Capital with Accelerators conceptually because startups before this stage are usually premature for Venture Capital Funds, though Angel Investors get involved. Venture Capital provides capital at the scale necessary for founders the result of (directly or indirectly) what we’ve covered thus far.

Bringing us full circle, back to Companies. Companies overlapping with Venture Capital in Corporate Venture Funds and the role Companies play in acquiring startups (delivering exists) that return investments to Venture Capital.

By the way, some of the most meaningful research of our time: Insight to WHY I refer so frequently to sectors and being industry specific – why we started MediaTech Ventures in a specialization rather than claiming programs ideal to every startup:

Adeo Ressi, founder of Founder Institute, one of the most renown Startup Development Organizations in the world, “Over 70% of Limited Partners want VCs focused on one stage with sector specialization. The data is in. Generalist VCs are out.“

A survey of LPs (Limited Partners – the people and organizations who invest in Venture Capital Funds) by RAISE found that LPs increasingly want to see specificity in funds: one stage, one sector.

Before I wrap up, let me point out one other subtlety of our Venture Development model.

The facets both overlap and appear opposite one another:

- Incubators are not Accelerators, as I already alluded

- Companies are private entities developing IP whereas Startup Studios are doing similar work but more publicly – as labs or partners

- And Venture Capital sits across from Coworking because the benefits of reduced costs and coincidental collisions in person means that founders are more wisely allocating capital resources to the work they should be doing.

A well “Venture Developed” startup ecosystem (i.e. a healthy startup ecosystem) is one in which these entities not only serve one another but that opposite entities work closely: Accelerators support Incubators to draw from them, Venture Capital sponsors or underwrites workspace so the ecosystem can afford what matters, Companies and Studios work in conjunction with one another in research, IP, and product development; all of that though, only possible, when each facet of the ecosystem also meaningfully overlaps with the counterparts that enable it to play the role it’s best suited to play.

Given the unusual nature of MediaTech Ventures, I’m frequently asked what I do. This is what I do. I work in Venture Development and hopefully with an appreciation of what that means (and what it seeks to accomplish), you can better grasp my role, if you’re familiar with me, and the way I work in doing that: I write (a lot) to help the world understand such things, I study markets and trends to guide where others might be go from here, I serve through meaningful startup programs, as many as I can, where my experience can make a difference to founders and investors. Through MediaTech Ventures, we partner with other Venture Development Organizations working in other sectors, in finance, and in government, and we develop with you the infrastructure makes a startup ecosystem possible.

Taken as a whole, a vibrant entrepreneurial ecosystem brings together and supports everything needed for the formation and growth of innovative, scalable businesses, including human, intellectual and financial capital.”

– David Rose; CEO of Gust

All, to bring Startup Development Organizations to life so that we can better inspire people to be entrepreneurs and enable entrepreneurs to take on the risks of being a founder.

Footnote: What is Venture Development? [Get in touch with us here if this is your goal] The focus of the private sector, in support of the public sector, to improve the outcomes of the efforts of entrepreneurs and early stage investors, through the direction, promotion, and development of the startup stage of an economy, driving innovation and new ideas, creating opportunities, and enabling a distinct, diverse, and accessible culture and ecosystem in which startups thrive. Venture development could be simply defined as increasing the rate of startup development and investor return. Many times these objectives include building or attracting Startup Development Organizations; improving economic policy in support of innovation spaces and coworking; ensuring sector-specific education to foster a workforce ready to work on behalf of startups in the region; enhancing community and communications to remove barriers to entry and create greater awareness; and incentivizing established companies to open a location in the region as those companies bring resources to bear on behalf of the entrepreneurs.

Companies w similarity also help startups to reduce the extra effort on business development, especially on company-specific domain knowhow. I was working for IC design house and here in Austin, there are ompanies like ARM, Samsung, AMD, MediaTek, etc. For system related startup, eg., topic in robotics, it would be easier to access more resource here than other places.

> Companies w similarity also help startups to reduce the extra effort on business development

PRECISELY

Align startups, mentors, programs, angels, venture capital, companies, and reports, around a sector, and you’ll see innovation thrive.

Great article, Paul! I 100% agree about the value of SDOs in the Startup Ecosystem. I was hoping for a shout-out about the Softeq Venture Studio here in Houston though! 🙂 We need to get you down for one of our events…you’ve never seen anything like it in Houston or Texas. Let’s go, Texas!

I’m back in #Houston much more Chris Howard and my thought is a deep dive on specific regions to explore and show how this works. Good call that it should be included here; I had to limit my list somehow (as there are many great SDOs!) so I thought it best to start with the ones with which I’m more directly familiar. ?

One of my favorite graphics & explanations from you, Paul O’Brien

Well written!

Very well written. Thank HOU for being a leader and visionary in this space, Paul O’Brien. And so great to see you and your team Megan and Josh today!

Christine Galib would love to collaborate in mapping #Houston this way ??

Joey Sanchez missed you on a quick visit yesterday!

David Gow, a different way to explore the region and how we all work together in the part that we play. Would love to catch up on my next visit, early Sept.

Thank you Paul O’Brien for being a great partner and champion for all the work we are doing in #houston

Deeply digesting and ruminating on this as you know how much I love mental models

You know I had some of our talks in mind

Great article, Paul! I 100% agree about the value of SDOs in the Startup Ecosystem. I was hoping for a shout-out about the Softeq Venture Studio here in Houston though! 🙂 We need to get you down for one of our events…you’ve never seen anything like it in Houston or Texas. Let’s go, Texas!

I’m back in #Houston much more Chris Howard and my thought is a deep dive on specific regions to explore and show how this works. Good call that it should be included here; I had to limit my list somehow (as there are many great SDOs!) so I thought it best to start with the ones with which I’m more directly familiar. ?

Thoughtful assessment of what can result reaching #criticalmass and then #escapevelocity.

Insane for a city to proclaim, “it’s all here, at this place, in this program, with this fund!” and then watch the community struggle in the scarcity of monopoly. Instead, nurture diversity, access to more, and support the new: fuel abundance and specialization, so that the entrepreneurs find that escape velocity thanks to MORE and more specific ??

Yet another cogent, thoughtful explanation of SDOs and the status quo. Thank you. Allow me to present yet another SDO model – a Venturator. This is an organization, led by and staffed by entrepreneurs, guiding startup founder entrepreneurs through the entire process – from incubation, to acceleration, and scaling. Obviously, a long process, yet with much better results (a 2X-10X increase in success rates for client companies). The goal is to teach founders how to think like entrepreneurs, and more importantly, like project managers. We provide a large pool of potential talent, mentors to guide them, and education in successful process (and planning) development sufficient to ensure success. Success is defined as a company that is growing sustainably at 30%+ per year, for the foreseeable future. They learn (and document) their processes, so they can repeat success (with product variation). This builds wealth throughout the client companies (and their investors), as well as local ecosystems. That’s the plan. That’s our plan. Hope it makes sense.

Greatly appreciate this information Paul. I love reading your viewpoint.

Really great graphic!

Thank you!!! Took some time to figure out how to get it right and meaningful

I wish SDOs did a better job of teaching founders how to interact with professional investors, i.e. how to negotiate from a position of strength, rather than just being seduced by VC marketing $s to rave about pitch competitions, etc.. Let’s put founders first and teach them how to exploit investors as much as investors exploit them. Being cash poor doesn’t mean you have to be a beggar, let’s give founders the negotiating tools they need, not just tell them they have to ‘dance for money’.

Can I add a wish? I wish local ecosystems would stop celebrating the SDOs that are only office hours and pitch competitions. There are a great many predatory entities in startup ecosystems… when a community vaunts less-than-stellar programs merely because they’re big or trying, or because it looks good, they’re actually doing the ecosystem a disservice: teaching founders, mentors, and investors that *this* is a best practice (how it should be done).

Understandably, if the community is going to rally around something, someone is going to fill that gap and provide it (in order to make money).

You’re right, we need to put founders first and teach them ?

Hence this set of distinctions about TYPES of SDOs. If a program isn’t teaching or funding, they’re a coworking space! Even if they have events, mentors, and office hours, they’re a coworking space. It’s up to the community to call it what it is, to help make sure a given type of SDO isn’t taking advantage of founders.

Paul O’Brien

Just like in any other field there are good, meh, and bad (SDOs). I always advise founders to follow the money to understand the motivation of an SDO. Some are fronts for investors (those pitch competitions and accelerators aren’t altruistic), some are commercial real estate plays (like WeWork), and some are truly supportive of start-ups. The first two are looking to exploit founders. Know who you are (really) dealing with, not just the smiling faces on their ‘community’ web sites.

Steve it sounds like you and I will enjoy a conversation when I’m back in Houston. Maybe next week…

Well said, Startup inspire entrepreneurship.

A critical stage of innovation, #startups uncover new business models that fuel global innovation and economic progress.

Can I quote you Leena? I’m working on a follow-up piece and your observation is perfect.